The Inevitable Policy Response (IPR) consortium has commissioned a report by Kaya Partners Trump, Trade &Tractors: 2024 Battle Fronts in the Climate Transition to identify the key emerging challenges and risks to the climate transition. This stands alongside the July Quarterly Forecast Tracker.

Our conclusion is that it is too early to see any of the battle fronts changing our longer-term forecast trajectory, despite the clear risks to our forecast ahead in the context of uncertainty of the US election outcome and the Chevron decision by the US Supreme Court. At the same time in Quarter 2, policy momentum remained supportive and the few changes to forecasts we have made are linked to what appears to be the specific policy and power market trends in India, South Africa, Indonesia, and Vietnam. We estimate the total forecast adjustment this year implies less than 3 GT of additional CO2 emissions until net zero.

The IPR Forecast Policy Scenario (FPS) is based on a comprehensive review of current and expected future policies across 21 jurisdictions and 15 key policy levers. The forecast is based on a quarterly review of hundreds of climate policy actions (announcements and legislation), an annual survey of +100 climate policy experts, and a comprehensive analysis of key market and technology trends. In 2023, IPR updated the FPS with a forecasted net zero year for CO2 emissions by 2050s for Advanced Economies and 2060s for Emerging and Developing Economies, implying a peaking of global temperatures at 1.8°C above pre-industrial levels in the latter part of this century.

IPR recognizes that its forecast – while anchored and consistent with the input from experts and analysis policy trends notably through the Quarterly Forecast Tracker project we have undertaken since COP 26 in Glasgow is considered optimistic.

2024 has surfaced a range of potential challenges for the IPR policy forecast, including a potential reshaping of the policy map as part of biggest global democratic vote series in human history, emerging geopolitical headwinds expressed via trade barriers and conflicts, as well as the continued political and social difficulties of decarbonizing agriculture. This report by Kaya Partners is designed to surface the key pain points and potential risks of these headwinds, focused on the US elections, the clean energy trade war, the role of Agriculture Inc, and the potential for Carbon Border Adjustment Mechanisms.

IPR is closely monitoring and assessing these four major areas and other trends to identify the potential need for forecast adjustments. The Kaya report is designed to give readers a perspective of the stakes and allow for readers to form their own perspectives on these challenges.

While IPR recognizes the potential headwinds identified in the report – including most eminently the Chevron decision and US election uncertainty – it will not action any short-term policy updates on the basis of this report. The looming clean energy trade war looks a daunting prospect but there are many twists and turns likely.

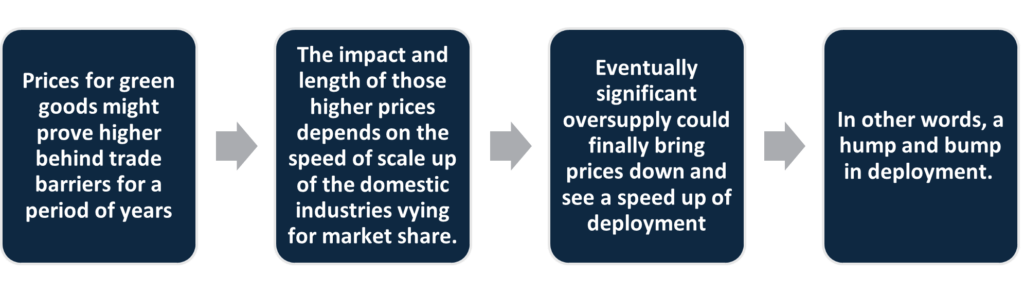

Our simplified assessment on the looming trade war that Kaya lays out identifies the following factors:

At the same time, IPR has identified the following policy areas for further monitoring and evaluation:

- Electric vehicles – Boom or bust?

The electric vehicle story in 2024 has been clouded by conflicting messages and exogenous impacts. The introduction of trade barriers in the electric vehicle market by the United States and Europe risk short-term affordability and range of consumer options. There appears to be some growing pains across the supply chain, from insurance to secondary markets to maintenance and charging infrastructure. Tesla’s role in the market likely also plays a role.

On the other hand, the cheapest EV models – according to recent Bloomberg analysis – are now cheaper than the average ICE car in the United States and companies are seemingly every week announcing new technological and cost breakthroughs. The Supreme Court ruling on Chevron raises the prospect of challenges to EPA vehicle emission standards.

The same inconsistent signals can be seen in the policy landscape. There is some signalling by major European political parties to move the phase out date for ICEs back to 2040 in Europe, although the opposite trend can be seen in the UK Labour Party manifesto, planning an acceleration of the phase out from 2035 to 2030 (consistent with the IPR forecast).The market continues to be shaped by volatile news.

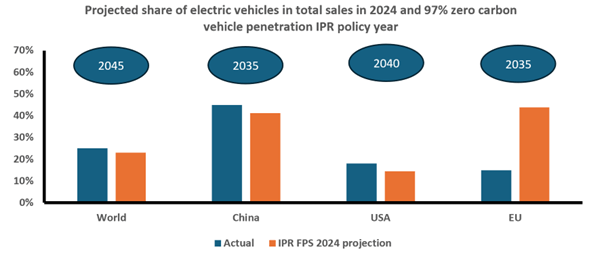

IPR’s current assessment is that there appears to be a ‘leapfrogging’ dynamic under way with emerging markets potentially on pace to accelerate deployment faster than developed markets. No example is perhaps starker than the decision by Ethiopia to ban imports for internal combustion engine vehicles, effectively moving to 100% electric vehicle deployment.

As a result, while Europe is set to significantly miss the FPS 2023 deployment forecast for 2024, IPR’s projected EV market share in 2024 of 23% is likely to be lower than the actual market share of 25%. This suggests that the European miss is offset elsewhere, an issue we will explore in more detail at a future QFT. Our preliminary assessment suggests we may be understating speed of deployment in emerging markets, as well as overestimating sales of internal combustion engine vehicles globally. However, these are just preliminary conclusions we plan to further review and as appropriate, feed into a forecast update.

At the same, the IPR forecast already has a slower trajectory for the US (ICE phase-out 2040) versus EU (ICE phase-out 2035) and so some built-in pessimism suggests that the Advanced Economy deceleration of the IPR forecast may just be limited in fact to Europe. On the other hand, as the Kaya paper shows, the US-China trade war risks being more pronounced, in particular in the context of the US election uncertainty. IPR will continue to monitor these trends.

In light of this continued uncertainty, IPR is not making any short-term updates to its EV forecast but is monitoring both emerging market policies for potential acceleration and developed market policies for potential deceleration.

2. Clean energy deployment:

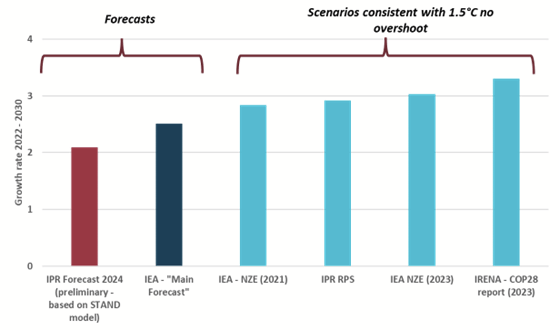

The potential trade war around clean energy creates significant risks for clean energy deployment in particular for developed markets. However, IPR has had a conservative view on renewable deployments this decade, given the expected headwinds from the 2023 high interest rate environment and broader deployment challenges related to grid capacity and permitting.

IPR did not forecast that the 11,000 GW tripling of renewables by 2030 goal from COP28 will be met. However, the short-term supply glut from China implies an accelerated deployment for Chinese renewables in China. Given the parallel deployment of coal, this change has not led to an adjustment of the Chinese clean power policy forecast.

Overall, IPR’s relative conservative view on renewables is consistent with higher-than-expected trade friction. Given the balance of risks and the expected increased electricity demand from AI, it appears more likely than not that IPR would accelerate its forecast of renewables deployment, rather than forecast a deceleration.

.

3. Mega elections:

IPR is closely monitoring the impact of the mega-election year on its forecasts, with the US election clearly the biggest source of uncertainty. The first Presidential Debate has left a lot of uncertainties for the Democrats. While IPR will review all policies, the outcome of the elections that have taken place to date, notably India, EU, France, and Indonesia, have not triggered a specific forecast adjustment.

Whilst our Indonesian coal policy has been updated, but this is not linked to the election outcome. In light of this significant uncertainty, IPR will postpone its 2024 forecast update to after the US election outcome has been decided.

4. Agriculture:

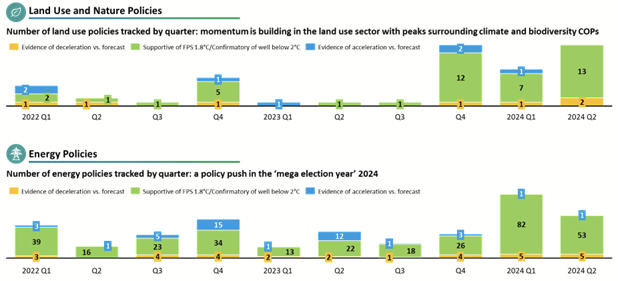

The continued challenges around ambitious agricultural policy represent one of the biggest threats to the IPR forecast. Related policies have been put on watch, although the recent passing of the EU Nature Restoration Law is a positive sign amid a sea of challenging policy headwinds. Moreover, a range of policy initiatives on nature and agriculture identified through the QFT process may suggest that there is more on the horizon, despite the failures to date. IPR will conduct a comprehensive review of its agriculture and nature forecast as part of its annual forecast scheduled to begin after the US elections.

Relating to the Quarterly Forecast Tracker and IPR Policy Forecasts

The policy momentum as tracked in the July QFT for Quarter 2 has not changed significantly with the largest proportion of announcements being supportive. Land Use and Nature continues to show a higher trend in announcements.

While none of the above is triggering a short-term policy update, IPR has made an update to its coal policy across several select emerging markets. The combination of a growing perception of global geopolitical risks, a potential acceleration in electricity demand driven by AI, but also the potential accelerated deployment of electric transport, is leading many emerging markets to reassess their electricity demand projections. While renewable deployment remains strong, this is likely to imply longer phaseout schedules for coal power and at least in the short-term in some markets some additional construction.

Coupled with shortcomings in the implementation of the Just Energy Transition Partnerships (JETPs) in some markets, IPR has downgraded the phase out of coal power in India, Indonesia, and South Africa by 5 years, with associated knock-on effects for +97% clean power in Indonesia and South Africa. We also are more explicit as of this quarter where policies have been achieved.

You can find our Q2 Policy Forecast Update including tracked policies here.